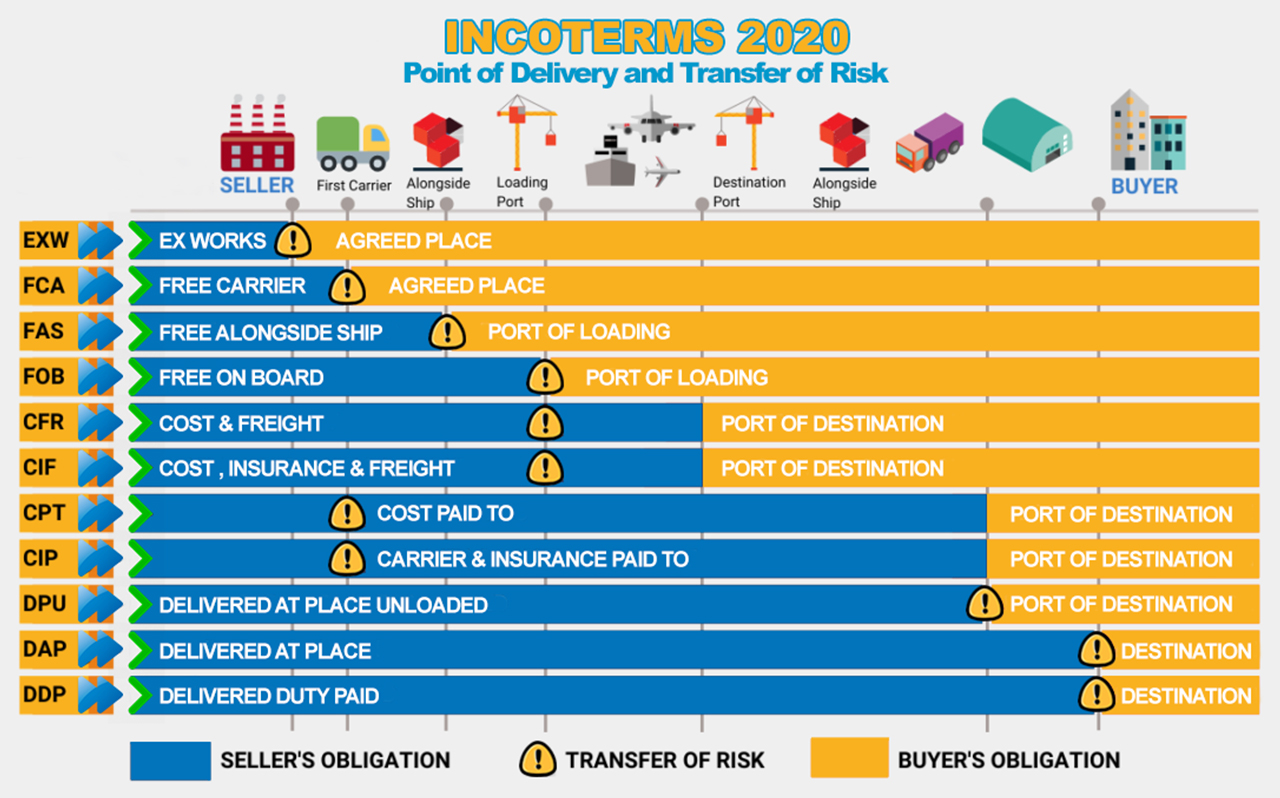

International Trade Agreement - Incoterms

INCOTERMS is a series of international sales terms published by international Chamber of Commerce (ICC) commonly used in commercial transactions with the aim of resolving any conflict and allocating responsibility between buyer and seller due to the policy differences among countries.

EX WORKS (... named place)

Ex-Work refer to the seller delivers when he places the goods at the disposal of the buyer at the sellers premises or another named place not cleared for export and not loaded on any collecting vehicle. This term of sale represents the minimum obligation for the seller, and the buyer has to bear all the cost and risks associated with the goods away from the sellers factory or premises.

FCA Free Carrier (...named place)

FCA means the seller needs to deliver the goods, clear for export, to the carrier nominated by the buyer at the named place. It should be noted that the chosen place of delivery has an impact on the obligations of loading and unloading the goods at that place. If delivery occurs at the seller’s premises, the seller is responsible for loading. If delivery occurs at any other place, the seller is not responsible for unloading

FAS Free Alongside Ship

FAS refers to the seller delivers and places the goods alongside the vessel at the named port of shipment. This means that the buyer has to bear all the costs and risks of loss of or damage to the goods after a handover. In additional, the seller must clear the goods for export.

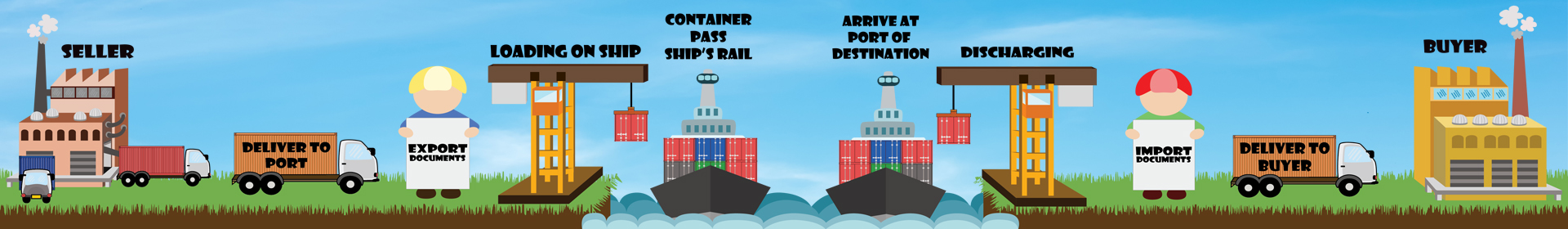

FOB Free on Board

FOB refers to the seller delivers the goods over the ship’s rail at the named port of shipment. This means that the buyer has to bear all the costs and risks of loss of or damage to the goods from that point. The FOB term requires the seller to clear the goods for export and only for sea or inland waterway transport. If the parties do not intend to deliver the goods across the ship’s rail, the FCA term should be used.

CFR Cost and Freight (...named port of destination)

CFR means the goods from sellers by which all the expenses and risks are covered up to buyers named destination. Any risk of loss or damage to the goods due to the events occurring after a handover is liable to the buyers

CIF Cost, Insurance and Freight (...named port of destination)

CIF is exactly the same as CFR except that the seller must procure insurance for the buyer applicable to maritime transport only.

CPT Carriage Pay To(...named destination of destination)

CPT means that the seller delivers the goods to the carrier nominated by them but they must in addition pay the cost of carriage necessary to bring the goods to the named destination. This means that the buyer bears all risks and any other costs occurring after the goods have been handed over to them.

DAF Delivered at Frontier (…named place)

DAF means the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport not unloaded, cleared for export, but not cleared for import at the named point and place at the frontier, but before the customs border of the adjoining country. The term ‘s rentier may be used for any frontier including that of the country of export. There, it is of vital importance that the frontier in question be defined precisely by always naming the point and place in the term.

DES Delivered Ex Ship (…named port of destination)

DES means the seller bears all the costs and risks to deliver the goods at the arrival of ship on board at the named port of destination and that goods made available for unloading to the buyer. Costs for unloading the goods and any duties, taxes and so forth are liable to the buyer. If the parties wish the seller to bear the costs and risk of discharging the goods, then the DEQ term should be used.

DEQ Delivered Ex Quay (…named port of destination)

DEQ means the seller bears all the costs and risks to deliver the goods to the quay (wharf) or the point at the named port of destination not cleared for import. The DEQ term requires the buyer to clear the goods for import and to pay for all formalities, duties, taxes and other charges upon import.

DDU Delivered Duty Unpaid(...named place of destination)

DDU means the seller delivers the goods to the buyer to the named place of destination in the contract of sale. The goods are not cleared for import or unloaded from any form of transport at the named place of destination. The buyer bears all the costs and risks for unloading, duty and any subsequent delivery beyond the named place of destination. However, if the buyer wishes the seller to bear the costs and risks beyond the named place of destination, then this should be explicitly agreed upon in the contract of sale.

DDP Delivered Duty Paid(...named place of destination)

DDP means the seller delivers the goods to the buyer, cleared for import, and not unloaded from any arriving means of transport at the named place of destination. The seller has to bear all the costs and risks involved in bringing the goods including any duty, where applicable for import in the country of destination.